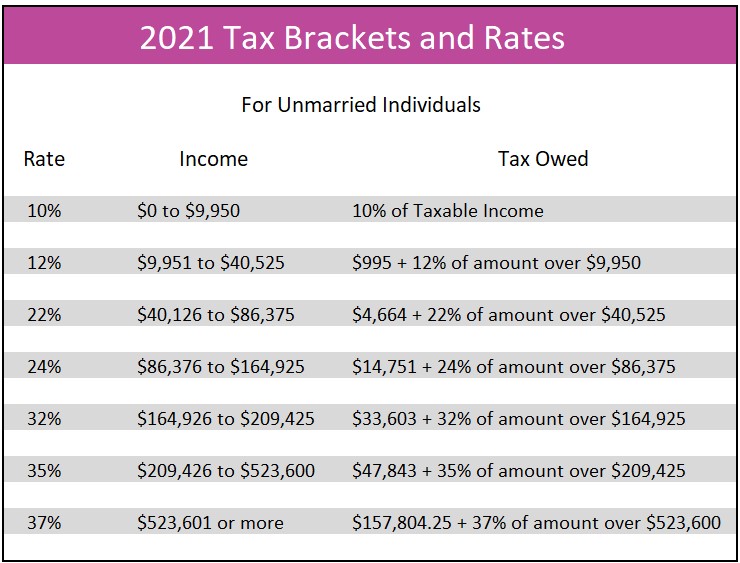

Progressive Tax Brackets 2024. How much of your income falls within each tax band; For tax years 2023 and 2024, those tax rates are 10%, 12%, 22%, 24%, 32%,.

That means different layers or portions of your income get taxed at different rates, depending on where they sit in the 2023 tax. The seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

For Tax Years 2023 And 2024, Which Apply To Taxes Filed In 2024 And 2025, There Are Seven Federal Tax Brackets With Income Tax.

Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including.

Explore The Latest 2024 State Income Tax Rates And Brackets.

The federal income tax system is.

For 2024, The Seven Federal Income Tax Rates Are 10%, 12%, 22%, 24%, 32%, 35% And 37%.

Images References :

Source: topdollarinvestor.com

Source: topdollarinvestor.com

95,000 a Year Is How Much an Hour? Top Dollar, The current tax year is from 6 april 2024 to 5 april 2025. That means different layers or portions of your income get taxed at different rates, depending on where they sit in the 2023 tax.

Source: www.nta.co.th

Source: www.nta.co.th

Coraggioso mar Mediterraneo piastrella federal withholding tax rate, For 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The current tax year is from 6 april 2024 to 5 april 2025.

Source: finance.lutonilola.net

Source: finance.lutonilola.net

Incredible How Do Us Tax Brackets Work References finance News, For tax years 2023 and 2024, those tax rates are 10%, 12%, 22%, 24%, 32%,. For 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org

Definition of a Progressive Tax Higher Rock Education, The current tax year is from 6 april 2024 to 5 april 2025. How much of your income falls within each tax band;

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, 2024 tax brackets (taxes due in april 2025) the 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets: Below, cnbc select breaks down the updated tax brackets for 2024 and.

Source: calendar2024irelandprintable.github.io

Source: calendar2024irelandprintable.github.io

Calendar Year Corporate Tax Return Due Date 2024 Calendar 2024, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. For tax years 2023 and 2024, which apply to taxes filed in 2024 and 2025, there are seven federal tax brackets with income tax.

Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

New Tax Rate Hot Sex Picture, Below, cnbc select breaks down the updated tax brackets for 2024 and. The current tax year is from 6 april 2024 to 5 april 2025.

Source: www.hotixsexy.com

Source: www.hotixsexy.com

Oct 19 Irs Here Are The New Tax Brackets For 2023 Free Nude, Many aspects of the tax cuts and jobs act , including the. Your taxable income is your income after various deductions, credits, and exemptions have been.

Source: www.reddit.com

Source: www.reddit.com

A quick analysis of Bernie Sanders' proposed progressive tax brackets, The current tax year is from 6 april 2024 to 5 april 2025. Progressive income tax involves tax brackets, each with its own tax rate.

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

Tax Brackets for 20232024 & Federal Tax Rates (2024), Tax brackets and tax rates. As you earn more money, the additional income jumps to a higher bracket with a higher.

Many Aspects Of The Tax Cuts And Jobs Act , Including The.

2024 federal income tax rates.

The Current Tax Year Is From 6 April 2024 To 5 April 2025.

Use the income tax estimator to work out your tax refund or debt estimate.